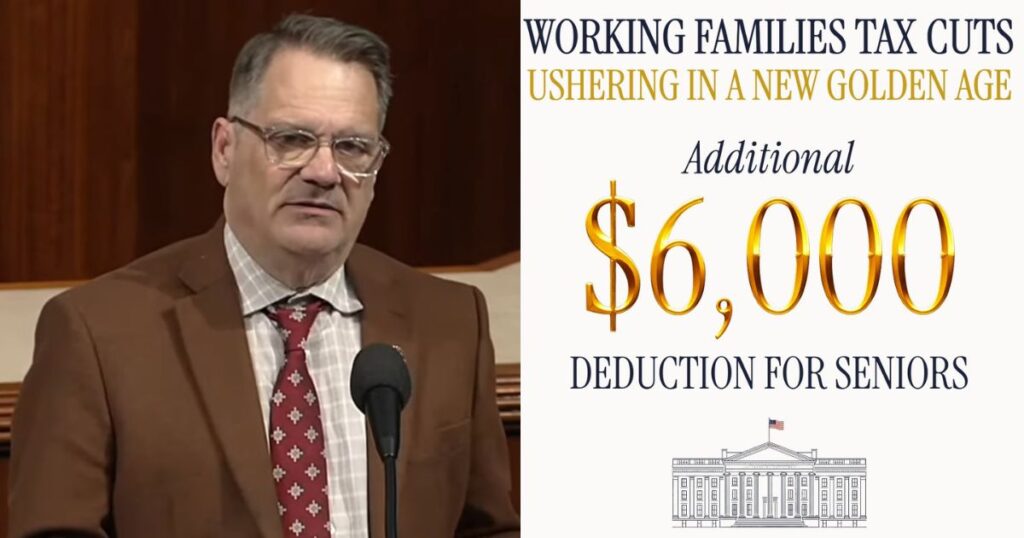

Rep. Gus Bilirakis has welcomed the Working Families Tax Cut Act, which is set to reform the tax code in the country and provide benefits to millions of citizens. The act was passed as a part of the One Big Beautiful Bill in July 2025.

From no tax on tips up to $25,000 to a $12,500 deduction on overtime pay, the law has various provisions that are expected to bring relief and joy. Senior citizens are especially likely to benefit from the new rules, as they have been granted an additional $6,000 income deduction.

This means that citizens aged 65 and older can subtract $6,000 from their taxable income for individual filing and $12,000 for joint filing. This amount stacks on top of the regular standard deduction.

As tax filing season begins, Americans are seeing the benefits of policies that prioritize hardworking families: bigger paychecks, larger refunds, and opportunities to build long-term financial security. In Pasco County, free income tax preparation is available at two locations… pic.twitter.com/svIMHTWIRb

— Gus Bilirakis (@RepGusBilirakis) February 6, 2026

Talking about how the act is going to make a difference in senior citizens’ lives, Bilirakis said while speaking on the House floor, “As tax filing season begins, important improvements to our tax code are already making a real difference for older Americans.”

The Florida representative added, “For too long, seniors were treated unfairly, Mr. Speaker, taxed on their Social Security benefits and left struggling to cover rising costs. That is finally starting to change. This year, a new $6,000 tax exemption for taxpayers aged 65 and older takes effect.”

The Republican leader further discussed the law’s on-ground impact, noting that it has already helped people in his constituency. He announced, “Last week, I visited a tax preparation site in Pasco County, Florida, and my constituents confirmed that this provision is helping them.”

Highlighting the provisions of the changed taxation, Bilirakis stated, “Enacted as part of the Working Families Tax Cut Act, this deduction applies through 2028 and is available, whether seniors take the standard deduction or itemize. It will benefit millions of Americans on fixed incomes, providing meaningful relief as costs for housing, health care, prescriptions and groceries continue to rise.”

Thanks to the Working Families Tax Cuts, individuals who are age 65 and older may claim an additional deduction of $6,000. This new deduction is in addition to the current additional standard deduction for seniors under existing law. pic.twitter.com/UR5LG9w9Zy

— Treasury Department (@USTreasury) February 10, 2026

According to an estimate by the administration, the deduction will exempt 88 percent of seniors from federal income tax. However, Bilirakis also pointed out that there is still a long way to go, as he wants seniors’ Social Security income to be completely tax-free.

The 63-year-old opined, “But our work is not done, Mr. Speaker. To many seniors, they still see their Social Security benefits taxed. That’s why I support legislation to fully exempt Social Security income from federal taxation.”

In addition to senior benefits, the Working Families Tax Cut Act is set to increase the Child Tax Credit to $2,200. The government has also launched ‘Trump Accounts’, which provide a $1,000 deposit for children born between 2025 and 2028.