Thousands of Minnesotans faced a harsh new reality this week as their names are now effectively excluded from vital federal small-business lending programs. This change comes as the Trump administration continues to investigate suspected pandemic loan fraud.

On Thursday, the Small Business Administration announced it had suspended 6,900 Minnesota borrowers after reviewing thousands of Paycheck Protection Program and Economic Injury Disaster Loan files. The agency identified nearly $400 million in potentially fraudulent loans associated with borrowers in the state. According to SBA Administrator Kelly Loeffler, this suspension involves 7,900 PPP and EIDL loans approved during the COVID-19 period.

Loeffler emphasized that this decision is not just a temporary measure, stating: “These individuals will be banned from all SBA loan programs, including disaster loans, going forward,” in a post on X. She also mentioned that the agency would refer cases to federal law enforcement for prosecution and repayment where appropriate.

Over the last week, SBA has reviewed thousands of potentially fraudulent pandemic-era PPP and EIDL loans approved in Minnesota.

Today, our agency took action to suspend 6,900 Minnesota borrowers amid suspected fraudulent activity. In total, these borrowers were approved for…

— Kelly Loeffler (@SBA_Kelly) January 2, 2026

For legitimate small business owners who depended on federal programs to get through the pandemic, the news serves as a reminder of how the urgency to provide relief allegedly allowed fraudsters to exploit the system. The PPP and EIDL programs aimed to help businesses stay afloat during lockdowns and the consequential economic downturn. However, investigators have long warned that quick actions and weak safeguards created opportunities for fraud.

The SBA’s move occurs amid growing political scrutiny regarding Minnesota’s image as a hotspot for fraud. Loeffler pointed out the significant concentration of suspected fraud in the state. She connected the SBA’s review to an expansive effort of alleged abuse in various public programs.

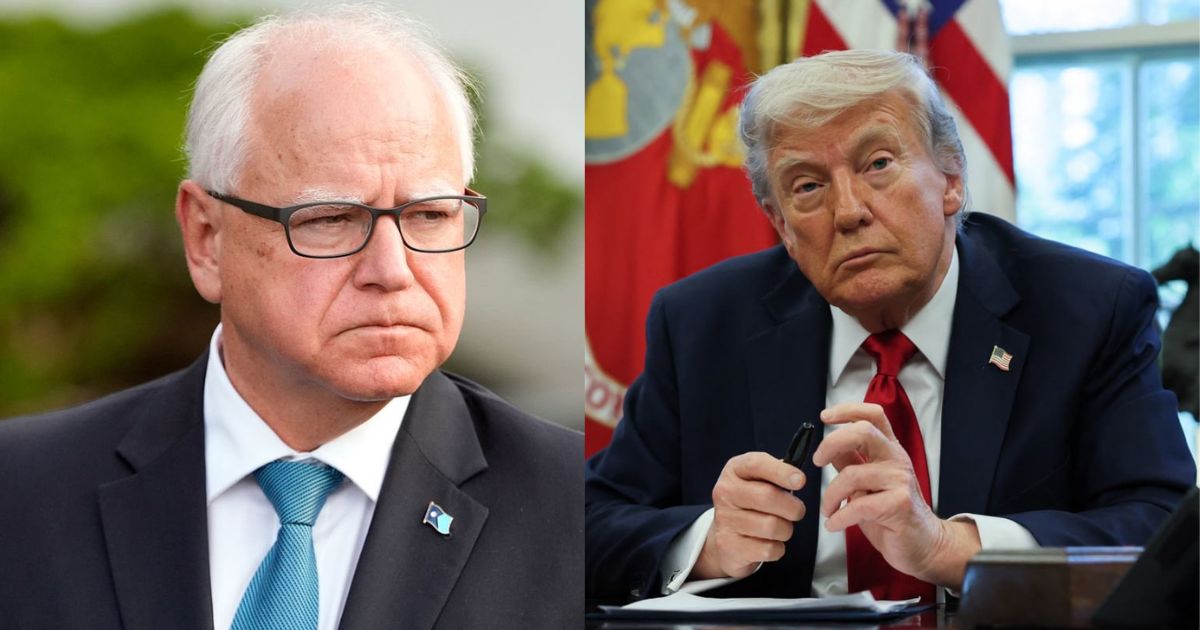

Loeffler informed Minnesota Governor Tim Walz that the SBA would stop over $5.5 million in annual support to SBA resource partners in Minnesota “until further notice.” She presented this funding freeze as a direct result of ongoing concerns.

Reports indicate the SBA found at least $2.5 million in PPP and EIDL funds from the pandemic linked to a Somali fraud scheme centered in Minneapolis. Loeffler also noted that about 13,000 PPP loans, amounting to $430 million, were flagged as potentially fraudulent but still funded, including loans that received forgiveness during the Biden administration.

CBS Minnesota reported that Loeffler did not provide more details about the allegedly fraudulent loans related to the 6,900 suspended borrowers. This leaves many questions about how the agency chose these cases and what will happen next for those who feel they were mistakenly included.

Federal investigators are increasing their activity in Minnesota on multiple fronts. The state has been highlighted nationally for claims of “industrial-scale fraud,” which includes the Feeding Our Future case involving fraudulent claims associated with the Federal Child Nutrition Program, along with other public assistance program investigations.

The upcoming phase will involve referrals, repayments, and prosecutions for cases deemed warranted by federal authorities. Minnesotans trying to run legitimate businesses are caught in the controversy. It is yet to be seen how the sudden federal freeze will impact businesses in the state.