Social Security was created 80 years ago with the sole purpose of providing pensions to retirees. However, with time, inflation rates changed. Life span increased, and the number of people contributing to 401K decreased. This fool-proof plan is no more fool-proof. Even Dave Ramsey says so.

Social Security has been a vital source of assistance for senior citizens since its establishment in 1935. The program currently offers more than 67 million people necessary financial assistance.

The average monthly payment in 2023 was $1,980. It is only marginally more than the poverty threshold for a household consisting of two people. This sum is definitely useful to the people. However, it is far from enough to support the typical retiree’s way of life.

Experts warn people that by 2035, the Social Security trust fund may run out. It might result in lower benefits or program changes. These changes show how important it is for people to take charge of their retirement preparation.

Reporter: A brand new analysis finds that Social Security would run out in six years if Trump’s agenda is enacted

pic.twitter.com/FiFSXo0501

— The Intellectualist (@highbrow_nobrow) October 21, 2024

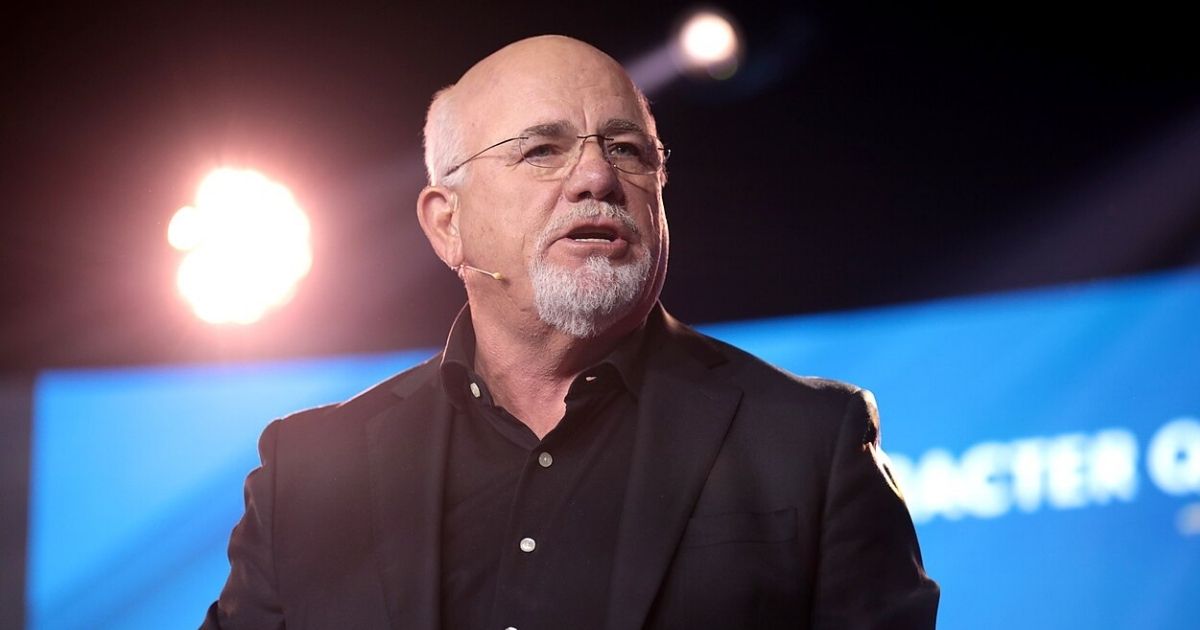

Dave Ramsey is one of the financial experts who have been helping people for years. He is known for his straightforward approach. He has recently raised a warning against 401K.

He cautions that the social security system was never intended to be the sole source of retirement income. However, far too many people have put their faith in it. There are millions of Americans who rely solely on social security benefits.

Dave Ramsey says it’s unreasonable to expect to live comfortably in retirement on Social Security alone. He emphasizes how important it is to collect personal wealth and save money in a variety of ways.

Different ways provide more control and more opportunity for long-term growth; Ramsey’s advice includes both Individual Retirement Accounts (IRAs) and 401(k) plans for one’s financial plan.

If you want to take control of your cash, there’s only one answer: Make a budget. That means figuring out what’s coming in and what’s going out each and every month—before the month begins.

I’ve been doing this for over 30 years, and I’ve helped tens of millions of people get… pic.twitter.com/8xAg6STl2K

— Dave Ramsey (@DaveRamsey) August 24, 2023

The main advice from Dave Ramsey is to keep 15% of one’s salary separate for the future. He also called the employer-sponsored 401(k) one of the most successful instruments. In this, employers provide a match to one’s own savings. He called it free money for saving.

Dave Ramsey often encourages employees to make use of this benefit. He aggressively advocates for Roth IRAs. Roth IRAs are beneficial due to their tax benefits and withdrawal flexibility. These accounts are an important supplement to other retirement income sources.

Roth IRAs enable retirees to grow their investments tax-free and withdraw money in retirement without paying extra taxes.

In case you were thinking of retiring some day, bad news from Janet Yellen:

Social Security and Medicare are now underfunded by $175 trillion.

That comes to roughly $1.4 million per American household.

There are only 3 solutions:

– slash beneficiaries

– massively hike taxes,… pic.twitter.com/mp9DK2dctn

— Peter St Onge, Ph.D. (@profstonge) March 27, 2024

Ramsey and other financial experts have a very important message. The timing of these messages is important as the country approaches a Social Security budget crisis.

People need to stop thinking about Social Security as a complete retirement answer. They have to view it as a part of a larger financial strategy instead. People can make significant progress toward a more secure and independent future by diversifying their sources of income. They must also increase their retirement contributions.

In conclusion, Dave Ramsey’s caution is an essential wake-up call. Many retirees may experience financial difficulties in their later years. However, the coming generation can avoid these situations if they plan and make personal efforts.