JPMorgan Chase CEO Jamie Dimon warned that President Donald Trump’s proposal to limit credit card interest rates to 10% could lead to an economic disaster. He stated it would cause lenders to withdraw sharply and could cut off access to revolving credit for millions of Americans.

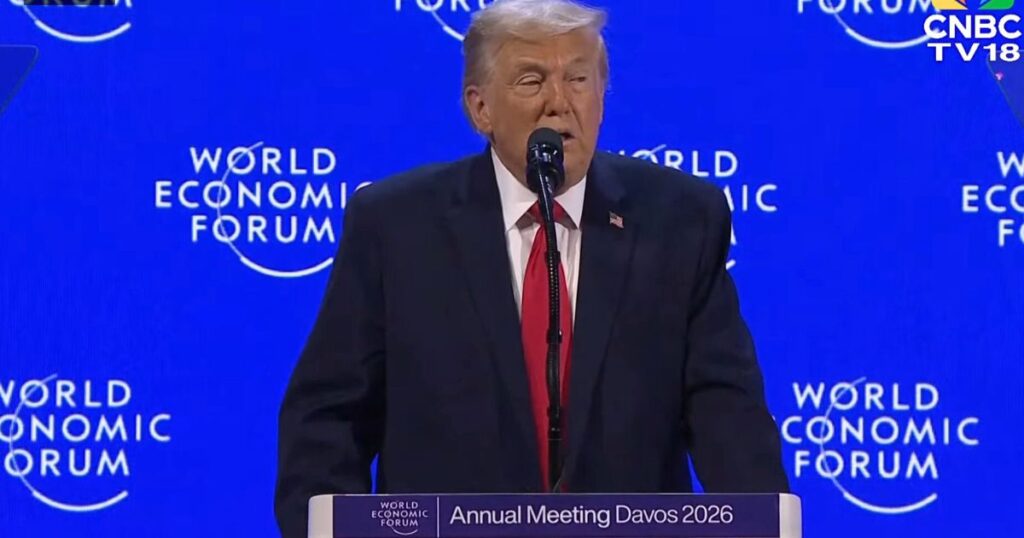

Dimon shared these views at the World Economic Forum in Davos after Trump renewed his call for Congress to set a one-year cap. This proposal is part of a plan aimed at providing relief for households ahead of the 2026 midterms. Trump has framed the cap as a way to lower borrowing costs and help families save for large purchases, such as housing.

Dimon indicated that the cap would reshape the credit card market. It would make it unprofitable for banks to lend to higher-risk borrowers, which includes many lower-income consumers and those with limited credit histories. “In the worst case, you would have a drastic reduction in the credit card business,” Dimon said in Davos. He added that it could “remove credit from 80% of Americans,” according to reports of his remarks.

Trump’s rate cap proposal has faced opposition beyond JPMorgan. Newsweek reported that five banking associations issued a joint statement expressing support for affordable credit but warned that a 10% cap would limit availability and harm families and small businesses that depend on credit cards.

Banks price credit cards based on several factors, including underwriting risk, funding costs, servicing expenses, fraud losses, and required capital. Lenders may respond to a hard cap by tightening approval criteria, lowering credit limits, or shifting borrowers to products with different pricing. Industry reports suggest that some large issuers have started to create new card products that would comply with a possible cap, rather than making changes to existing portfolios.

🇺🇸 PRESIDENT TRUMP: credit card companies will be in “violation of the law” if they charge over 10% interest rates after January 20th. pic.twitter.com/aNrJr5wwrI

— Crypto Rover (@cryptorover) January 12, 2026

Trump has linked the credit card cap to other affordability proposals, including plans he has labeled as a ban on large institutional investors buying single-family homes. Reuters previously reported that Trump stated his administration was working to limit Wall Street firms from purchasing homes, though the exact legal method and details were not immediately clear.

While in Davos this week, Trump also mentioned that he would instruct federal agencies to buy hundreds of billions of dollars in mortgage-backed securities to help lower mortgage rates. Economists cited in reports on this plan have raised concerns about how much impact such purchases would have on monthly payments. They noted that mortgage pricing reflects broader interest rate conditions and investor expectations.

Dimon, whose bank is the largest in the U.S. by assets, said JPMorgan would likely handle a rate cap better than smaller issuers. However, he argued that the overall effect on consumers would be severe, as many households use credit cards for emergencies.

The debate is unfolding as inflation and interest rates remain crucial political issues heading into 2026. While overall inflation has decreased from earlier peaks this decade, credit card annual percentage rates have stayed high, reflecting the Federal Reserve’s raised interest rate environment and the risk associated with unsecured lending.

Trump has repeatedly claimed that his administration’s economic strategy is strengthening household finances and has presented the credit card cap as a focused measure to lower costs without broader changes. Dimon and banking trade groups have countered that the policy would shift costs in ways that limit access rather than enhance affordability.

Congress has not scheduled a vote on Trump’s proposal, and it is uncertain what bipartisan support exists for a nationwide cap at the level and duration the president has suggested. The White House has not provided legislative text, and the administration has not clarified how regulators would ensure compliance across card issuers and co-branded programs.