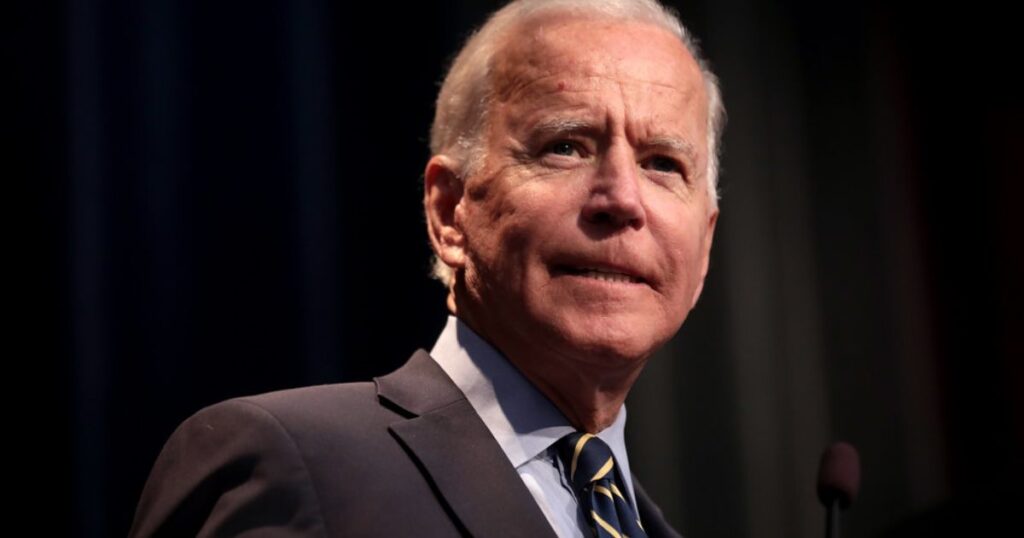

GOP lawmakers ended 2025 with a bragging-rights win that is going to echo well into next year as they wiped out a record number of Biden-era regulations with President Donald Trump signing the rollbacks into law.

Republicans undid 22 regulations issued in the final months of former President Joe Biden’s presidency. The rollbacks hit rules that restricted fossil fuel production, supported state-level efforts to phase out the sale of gas-powered cars, and aimed to limit what big banks could charge customers in overdraft fees. Republicans used resolutions of disapproval, the fast-track tool created under the Congressional Review Act, to do it.

It is the most CRA rollbacks signed into law by any Congress since the law was enacted in 1996. Once a rule is knocked out this way, agencies are generally blocked from issuing a “substantially similar” version later, unless Congress passes a new law allowing it.

On energy, the Republicans are trying to open the valves and, as Trump puts it, ‘drill baby, drill’. Some of the repealed actions were designed to narrow where and how drilling, leasing, and extraction could proceed, especially on federal lands. Environmental lawyers and land-use experts have warned that tossing out land-use plans through the CRA can create confusion because plans are not like single-point regulations; they are the map. When the map is suddenly invalidated, you do not just get a new direction; you get disputes over what rules apply while agencies scramble to rebuild the framework.

The legislation on cars is one of the highest-profile fights in 2025, and it has been over California’s power to set stricter emissions standards and push aggressive electric-vehicle timelines. Republicans moved to block Biden-era approvals and waivers tied to those mandates, and the result is a legal and regulatory brawl that is still unfolding.

The practical question is whether states that followed California’s lead can keep pushing toward gas-car phaseouts as planned, or whether the federal government is now slamming the door on that pathway. Either way, automakers are stuck watching Washington and the courts while trying to plan product lines for years.

Then there is the consumer finance piece, which is where the rollback hits ordinary people in a very direct way. One of the reversed rules was aimed at capping overdraft fees at very large financial institutions, part of a broader Biden-era push to treat overdraft as a form of high-cost credit. Republicans described the rule as government overreach into how banks price services.

Some feel that it’s basic protection for people who get slammed with fees when they are already short on cash. With the repeal, banks keep more freedom to charge, and the debate shifts from a federal ceiling to a patchwork of bank policies, state politics, and public pressure.

Supporters of the rollbacks say this is exactly what voters asked for: fewer restrictions, lower compliance costs, and less bureaucracy in making economic decisions.

The GOP played hardball by pushing the bounds of a little-known statute to undo federal rules, which could possibly undermine the filibuster. The Republican push to take a more aggressive stance on reversing Biden’s regulations comes as the party has largely given other legislative branch agendas, such as overspending and oversight, to the Trump administration.