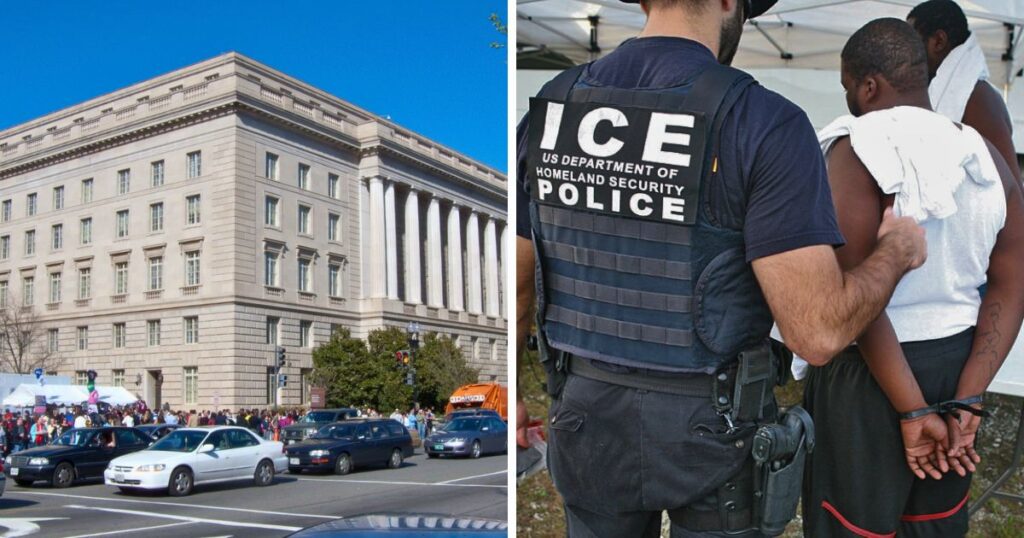

There is a wave of resignations inside the IRS because of a plan to share millions of taxpayers’ confidential records with Immigration and Customs Enforcement (ICE). This deal has led to an internal revolt at the nation’s tax agency and has already cost the IRS much of its senior leadership. The future of tax compliance itself is now in question.

At the center of the controversy is a new system the IRS is working on, wherein ICE could request batches of taxpayer home addresses whenever they want. ProPublica got its hands on the technical documents for this process, and it’s a privacy red flag. Usually, tax information is locked under federal law, but this system would hand ICE alarming levels of access they’ve never had before.

Acting IRS Commissioner Melanie Krause is resigning. So are the agency’s chief privacy officer, chief financial officer, chief risk officer, and several senior legal and IT officials. Others were pushed out after objecting to the plan.

One former official told CNN that it felt like a “hostile takeover.”

🚨BREAKING: Acting IRS Chief Melanie Krauss just RESIGNED over IRS agreement to share data with immigration authorities.

Good riddance. pic.twitter.com/l0cdq8pbru

— Derrick Evans (@DerrickEvans4WV) April 8, 2025

In June, acting IRS general counsel Andrew De Mello refused an ICE request seeking the addresses of roughly 7.3 million taxpayers. In an internal email obtained by ProPublica, De Mello warned the request didn’t meet legal requirements, including the need for written assurances that each person was under a criminal investigation. Two days later, De Mello was forced out!

Career IRS officials say the demand is very different from what has been practiced for decades. Historically, law enforcement requests for tax data were rare and only involved a handful of people. What DHS was pushing for was a mass data dump.

Privacy experts say unauthorized disclosure of taxpayer information is a felony and is punishable by up to five years in jail. And the new system strips away human oversight as it automates approvals and just relies on ICE certifications. As the system starts with names rather than taxpayer IDs, it could return incorrect or outdated addresses and send agents to the wrong doors. With no built-in limits on how much data can be requested, the platform could also be expanded to pull employer/family information.

The Trump administration is unapologetic, though.

The White House says this data-sharing deal is legal according to tax laws, and we need it to make good on the president’s mass deportations promise during the campaign. Treasury and Homeland Security keep pointing to the agreement they signed in April.

BREAKING: The IRS has been colluding with other federal agencies to conduct warrantless surveillance on American citizen’s financial records “en masse” without abiding to the legal process, according to new report. pic.twitter.com/VBKPFnnCum

— Patrick Webb (@Patrickwebb) March 22, 2024

A federal judge decided not to stop the agreement back in May, but the ruling didn’t touch on the tech system they’re building now. The case isn’t closed either, so there’s a good chance it’ll get dragged back into court.

For years, the IRS has told people that if they’re making money in the U.S., they need to file taxes no matter their immigration status. They promised people their personal information wouldn’t be used for anything besides taxation. But undocumented immigrants are paying tens of billions in taxes every year to both the federal and state governments.

If these people get scared of getting deported, they may withdraw from the system. And the government loses billions.

NEXT UP: A Big IRS Tax Refund Could Be a Red Flag – Here’s Why