Donald Trump’s return to the White House sparked a major rush on Wall Street and in the crypto world. The excitement stemmed from the belief that anything even slightly connected to Trump or his family would soar once he regained power.

For a time, this belief proved true as traders excitedly bought stocks, meme coins, and other “themes” linked to Trump, hoping their closeness to the presidency would lead to influence, access, and profits. Now, a year later, the consequences are tough for many investors.

“Sometimes irrational exuberance meets the brick wall of logic,” said Art Hogan, chief market strategist at B. Riley Wealth, explaining why many of these trades are now falling apart.

Trump Media & Technology Group, the parent company of Truth Social, trades as DJT, Trump’s initials. It became a market gauge for Trump’s political fortunes. In the lead-up to the 2024 election, the stock climbed as investors rushed in, even though the company had not shown it could make lasting profits. At one point, Trump Media was valued at around $11 billion.

Trump Media has dropped sharply from its pre-election peak, losing much of the value gained during the boom. Despite Trump using Truth Social as a key platform for his presidential messaging, the user base has not grown as traders expected. In November, Truth Social attracted about 1.5 million monthly active users in the U.S. on iOS and Android, falling far short of platforms like X and Reddit, and even behind Bluesky, according to Similarweb data shared with CNN.

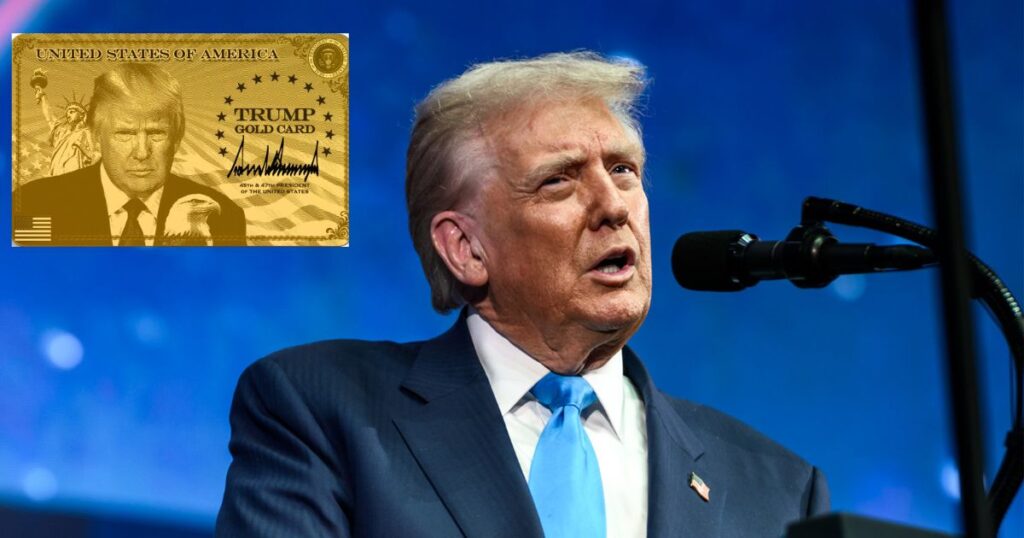

Next came the meme coins, a pure form of speculative enthusiasm around Trump. The official Trump meme coin was launched just before he took office and quickly became a source of political, financial, and ethical debate. It reached a peak market value near $9 billion in January, then fell sharply. By mid-December, it was trading around the mid-single digits, down roughly 88% from its high.

First Lady Melania Trump’s meme coin saw a more drastic drop. After peaking around the inauguration, it plunged to about a dime, wiping out early excitement and falling about 99% from its peak.

Other Trump-linked crypto projects have struggled to maintain interest. American Bitcoin, a bitcoin miner and treasury-style venture backed by Donald Trump Jr. and Eric Trump, surged after its Nasdaq debut in September but then declined. This happened due to a broader pullback in crypto and selling pressures from share lockups ending. World Liberty Financial’s token also rose initially but then dropped, with its price falling well below its highs after launch.

Not all “Trump trades” involved crypto. Investors also jumped into private prison stocks, believing an immigration crackdown would fill detention centers and drive revenue up.

GEO Group, a major operator of immigration detention facilities, soared to an all-time high just before Trump took office, then sharply declined as the administration focused more on deportations to other countries instead of expanding domestic detention at the pace traders anticipated.

“I’ve given up on private prisons,” said Matthew Tuttle, CEO and chief investment officer at Tuttle Capital Management. “Many thought ICE would round up people and they would stay in private prisons. I didn’t expect them to send people to El Salvador and other places.”

Bitcoin remains significantly higher than its pre-election trading levels, despite pulling back from record highs. European aerospace and defense stocks have also surged as NATO allies face new pressure to increase spending, a trend some traders link to Trump’s stance on alliances and defense budgets.

For investors who cashed out early after Trump’s victory sparked the surge are the real winners. However, those who kept the bet on Trump would see most of their investment wiped out.